Triggers can be such a drain on your brain! What do they affect? Your thoughts capture a trigger. A whole lot of thinking, more thinking and hormones induced because of the thinking of what is wrong, why it's wrong, how it's wrong...etc, etc,. This kind of rampant agony can stop the kind of focus that produces results. When a credit problem has worked your last nerve, you have to prioritize your emotions because it will take a toll on you.

Triggers can be such a drain on your brain! What do they affect? Your thoughts capture a trigger. A whole lot of thinking, more thinking and hormones induced because of the thinking of what is wrong, why it's wrong, how it's wrong...etc, etc,. This kind of rampant agony can stop the kind of focus that produces results. When a credit problem has worked your last nerve, you have to prioritize your emotions because it will take a toll on you. 4 steps in Getting Focused:

1. Change how you thin about your problems; Our minds start running like water and it sometimes it doesn't stop. If you identify those "stress" triggers. You can improve your goal management quickly.

2. Multi-tasking is draining and must be limited: Some people are born to task their tails off. I am one of them; but even I have limits. Identify the priority in each given day and multi-task based on totality if you can handle that. Priorities are meant to remind you and not overwhelm you.

3. Coordinating your timeline of problem requires focusing in the now: What is within your control today is what will propel tomorrow. Thinking to far into a situation that requires interment steps creates alot insecurity and tons of overwhelm.

4. Get HELP! We are in a do it yourself world and much as I can truly understand that; frustration and stress often can be beat with the help someone able, willing and capable to work with you on your goal all the way to the solution.

Make 2015 your best year yet! Get clear, focused and have a commitment to yourself first and foremost. Wanting and even desiring a better life, more money, amazing credit and just a feeling of security in your direction takes a pure and honest personal assessment of you.

Cheers to your success!

Alexis - The Credit DIVA!

RSS Feed

RSS Feed Twitter

Twitter

3:00 PM

3:00 PM

Alexis P. Jones, The Credit DIVA

Alexis P. Jones, The Credit DIVA

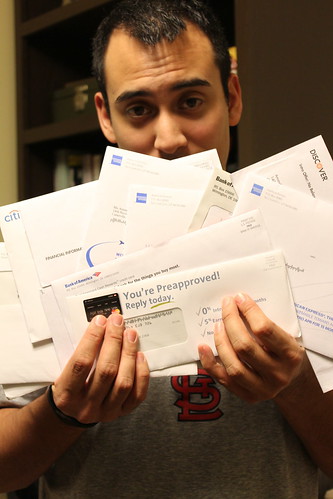

Now this post is not intended to create fear in what you have experienced for a long time, but awareness is important because of the new ways of manipulation that do in fact affect your understanding of how and why you may notice a company that has gathered some data on you. The action of pre-screening you generates those mailed offers and in some instances, the knowledge of your credit potential is revealed. If you have good credit and want some low-interest rate credit or loans; this action could be appealing. If your credit is going through a patch and you are sensitive to what and whom can see your reports than that is something you can control.

Now this post is not intended to create fear in what you have experienced for a long time, but awareness is important because of the new ways of manipulation that do in fact affect your understanding of how and why you may notice a company that has gathered some data on you. The action of pre-screening you generates those mailed offers and in some instances, the knowledge of your credit potential is revealed. If you have good credit and want some low-interest rate credit or loans; this action could be appealing. If your credit is going through a patch and you are sensitive to what and whom can see your reports than that is something you can control. Junk mail is the leading annoying factor in those special sale opportunities for potential credit promotions designed to get your attention and consider the offer. Bad credit promotions are even more aggressive as the interest rates on those offers are generally so high and outrageous, many people get in a bad situation with funky fees and auto-billings. In an earlier post, you can check out how and why ordering your Annual Credit Report is the beginning of tracking these types of activities. If you haven't done so, take the time to order your reports. You should know what and who is checking up on you. You can do so for free at www.annualcreditreport.com. This website does not provide credit scores for free.

Junk mail is the leading annoying factor in those special sale opportunities for potential credit promotions designed to get your attention and consider the offer. Bad credit promotions are even more aggressive as the interest rates on those offers are generally so high and outrageous, many people get in a bad situation with funky fees and auto-billings. In an earlier post, you can check out how and why ordering your Annual Credit Report is the beginning of tracking these types of activities. If you haven't done so, take the time to order your reports. You should know what and who is checking up on you. You can do so for free at www.annualcreditreport.com. This website does not provide credit scores for free. There was a time when having a bad or challenged credit history could save you from pirates and thieves, but all that has gone away with Cyber activity and the use of stolen data. Even in situation where your credit score is not directly impacted by some kind of breach, your "liking or personal details" are in fact on the hook. A new persona can be created without your social security number. Be your champion this year and get your mind on your credit business. Your future does depend on it. I hope you enjoyed this post. Let us know how we can help you with your goals.

There was a time when having a bad or challenged credit history could save you from pirates and thieves, but all that has gone away with Cyber activity and the use of stolen data. Even in situation where your credit score is not directly impacted by some kind of breach, your "liking or personal details" are in fact on the hook. A new persona can be created without your social security number. Be your champion this year and get your mind on your credit business. Your future does depend on it. I hope you enjoyed this post. Let us know how we can help you with your goals.

.png)

.png)

.png)

.png)